Since Article 153 of the 2020 French Finance Law was announced, ICD International has had the honor of participating in various workshops led by the French Directorate of Public Finance DGFIP. These workshops will set the technical and operational conditions for applying the law.

We are pleased to inform you about some of the progress that was made based on the February 2020 workshop. Three main topics were covered:

- Definition of the main objectives for e-invoicing, along with an implementation calendar

- Characteristics of the data to be transmitted

- Definition and principles of e-reporting

1) DEFINITION AND MAIN GOALS

According to DGFIP, an e-invoice (electronic invoice) is defined as being a document that includes all the invoice information related to an invoice sent to a customer and tax authorities. The electronic invoice implemented by DGFIP has four main goals:

- Strengthen VAT fraud prevention and the fight against fraud

- Reduce invoice processing costs in order to improve competitiveness

- Improve knowledge about the economic situation by continually providing information concerning company activity.

- Reduce filing costs and simplify declarations with pre-filled documents in the long-term

IMPLEMENTATION CALENDAR

Obligatory electronic invoicing, combined with transmission to tax authorities, is scheduled for July 1, 2024 at the earliest (previously planned for 2023) and January 1, 2026 at the latest. In particular, implementation must take the size of impacted companies into account:

2024: Requirement for all companies to receive electronic invoices; requirement for large companies to issue invoices in electronic format

2025: Requirement for mid-sized companies to issue electronic invoices

2026: Requirement for VSE and SME companies to issue electronic invoices

2) CHARACTERISTICS OF DATA TO BE TRANSMITTED

There are two different types of cases regarding data:

- Data sent natively in a structured format

- Data sent in a simple PDFformat

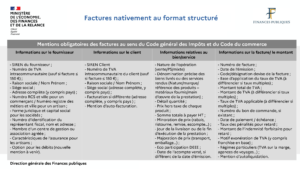

For invoices sent in structured format, the data to be extracted for tax authorities includes:

- All mentions required by tax regulations and commercial law

- Two new mentions that are useful to include as a requirement for invoices: VATpayment options on debits and the nature of the operations (sales, service, combined) [Note: the customer’s business license number (SIREN in France) is already information required by the French Commercial Code].

Long-term objective: progressive elimination of PDF format, both native and non-native

Mentions obligatoires des factures au sens du code général des Impôts et du code du commerce

Required information on invoices according to France’s General Tax Code and French Commercial Code

3) Definition and principles of e-reporting

Establish an obligation to electronically send tax/administrative authorities information concerning operations performed by parties subject to added value tax, that is, information not extracted from electronic invoices:

- Additional information

- Information about operations outside the scope of electronic invoicing

- Information about operations not subject to VAT invoicing

- When using invoicing applications: data sent to authorities shall be identical to that send for e-invoicing. It is worth noting that for B2C cases, a customer identifier is only required if it exists in the application.

- When cash register software is used, a daily summary (“Z ticket”) shall be sent to authorities.

- In cases where only accounting software is used: aggregated data with transaction amounts for B2C sales and service transactions. For international B2B: operation details with the client identifier will be required.

- If software is not used: aggregated data for sales and performed services – pre-tax amounts, VAT rate, VAT amount, reason for exemption.

Workshops with DGFIP will escalate as we move forward. Upcoming topics to be covered include:

| Technical workshops | Calendar |

| Archives | March |

| Formats | April |

| Control | April |

| Certification | May |

Technical and functional conditions for e-reporting should be presented in a bulletin to be published within 9 months, no later than September 28.

We will keep you posted on progress after each workshop so that you can start getting ready for the next milestones.

We are at your service to help with any questions you may have, or to provide information about Article 153 of the 2020 French Finance Law.