Avril dernier, les parties prenantes du FNFE-MPE, le forum national de la facture électronique et des marchés publics électroniques, se sont réunies pour conseiller les entreprises françaises qui se lancent dans la dématérialisation de leurs factures. Ce déploiement obligatoire vers la facture électronique concerne toutes les entreprises assujetties à la TVA. C’est pourquoi, nous avons voulu vous proposer une synthèse des thèmes évoqués durant cette conférence et vous fournir les axes de réflexion clés pour aborder sereinement ce processus de dématérialisation des factures.

Petit rappel : Qu’est-ce qu’une facture électronique ?

Préalablement, il est important de rappeler ce que l’on entend par facture électronique. Ce sont toutes les factures créées, émises et reçues qui s’échangent de manière électronique entre les fournisseurs et les acheteurs par l’intermédiaire d’opérateurs de dématérialisation. Contrairement à une idée reçue, le format PDF n’est pas considéré comme une facture électronique.

Les factures électroniques sont soumises à des conditions légales spécifiques. En effet, selon l’article 289 du CGI VI et 233 de la Directive TVA 2006/2010 : « L’authenticité de l’origine, l’intégrité du contenu et la lisibilité de la facture doivent être assurées à compter de son émission et jusqu’à la fin de sa période de conservation».

Pour parvenir à cette conformité fiscale sur les factures électroniques, la solution est de suivre le standard européen EN 16931, c’est-à-dire des protocoles EDI (d’échanges de données informatisés) validés par l’administration fiscale. Pour ce faire, l’un des trois formats suivants est possible : UBL XML, CII XML ou Factur-X. Le dernier format est dit hybride puisqu’il se fonde à la fois sur le format PDF connu des entreprises mais s’intègre également sur les plateformes de dématérialisation prévues dans la réforme fiscale de 2024.

Sommaire :

La suite de cet article traite les questions que vous devez légitimement vous poser pour déployer la facture électronique dans votre entreprise :

- Quels sont les objectifs visés par les autorités publiques françaises sur la facture électronique ?

- Quelles sont vos échéances, suivant la taille juridique de votre entreprise ?

- Sur quel modèle la DGFiP s’appuie-t-elle pour organiser cette dématérialisation des factures ?

- Quels gains peuvent espérer les entreprises qui se lancent dès aujourd’hui dans la facture électronique ?

- Quelles sont les bonnes pratiques à adopter pour accompagner le processus de dématérialisation des factures ?

1. Quels sont les objectifs visés par les autorités publiques françaises sur la facture électronique ?

La DGFiP (Direction Générale des Finances Publiques) est l’autorité publique en charge de la mise en œuvre effective de la dématérialisation des factures par les entreprises assujetties à la TVA. D’après leur rapport sur la TVA à l’ère du digital, la facture électronique obligatoire remplit 4 objectifs :

- Faciliter la procédure de déclaration TVA via un pré-remplissage des déclarations ;

- Réduire la fraude à la TVA ;

- Avoir un aperçu en temps réel de l’activité des entreprises pour pouvoir mieux ajuster les politiques fiscales ;

- Accroître la compétitivité des entreprises grâce aux bénéfices liées à la dématérialisation des factures.

Depuis ce rapport datant de 2020, de nouvelles exigences ont été apportées. Le champ d’application des obligations ne se limite plus à la réception et l’émission de factures sous format électronique (e-invoicing) sur les transactions domestiques entre assujettis à la TVA mais s’étend par ailleurs à la transmission des données électroniques (e-reporting) à la fois sur les transactions en B2B international (avec un assujetti non-résident en France) et sur celles effectuées par des entreprises avec des consommateurs (B2C) nationaux.

2. Quelles sont vos échéances, suivant la taille juridique de votre entreprise ?

La France compte près de 4 millions d’entreprises qui sont en majorité des très petites entreprises (TPE). Les autorités fiscales françaises ont donc pris acte de cette configuration pour établir leur calendrier obligataire sur la facture électronique. S’appuyant sur ce contexte national, la réforme fiscale envisage de rendre obligatoire la facture électronique en procédant en deux étapes : la réception, puis l’émission de ces factures.

Elle prévoie un calendrier fixe sur lequel les entreprises doivent s’ajuster.

1ère étape concerne la réception des factures sous format électronique : Toutes les entreprises (les grandes entreprises, les ETI, les PME et TPE) assujetties à la TVA seront dans l’obligation à partir du 1er juillet 2024 de pouvoir recevoir les factures électroniques.

2ème étape concerne l’émission de factures électroniques : Cette étape va s’effectuer de manière différée et progressive pour tenir compte de la maturité numérique de chaque unité légale afin que le dispositif d’émission de factures électroniques soit correctement installé.

- 1er juillet 2024 : les grandes entreprises (GE)

- 1er janvier 2025 : les entreprises de taille intermédiaire (ETI)

- 1er janvier 2026 : les petites et moyennes entreprises (PME), les microentreprises et les autoentrepreneurs

Ainsi, le calendrier se veut strict mais les délais choisis sont définis dans un temps imparti réaliste. Toutefois, les entreprises doivent prendre conscience le plus tôt possible des échéances pour mieux se préparer à cette obligation.

3. Sur quel modèle la DGFiP s’appuie-t-elle pour organiser cette dématérialisation des factures ?

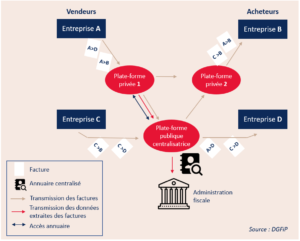

La DGFiP compte se fonder sur le modèle Y qui s’inspire du système mis en place dans les pays d’Amérique latine au début des années 2000.

L’illustration suivante présente les différentes parties prenantes de ce modèle : y sont inclus les entreprises assujetties à la TVA (fournisseurs et acheteurs), les opérateurs de dématérialisation (comme ICD International) et l’administration fiscale (la DGFiP).

Modèle Y pour la facture électronique obligatoire

Dans un souci d’interopérabilité, la DGFiP accrédite des opérateurs de dématérialisation pour qu’ils puissent proposer leur plateforme de dématérialisation partenaire (PDP). Les entreprises fournisseurs et acheteurs devront se greffer à l’une de ces PDP. Ainsi, les factures et rapports fiscaux électroniques générés seront convertis, archivés et transmis, suivant un protocole de communication préalablement défini, aux bons destinataires. Quant à l’administration fiscale, elle répertoriera toutes les informations fiscales des entreprises reçues par les PDP au sein de son “Annuaire” et contrôlera les transactions à l’aide de son logiciel, Chorus Pro, intégré à sa plateforme publique de facturation électronique (PPF).

4. Quels gains peuvent espérer les entreprises qui se lancent dès aujourd’hui dans la facture électronique ?

Des grandes entreprises telles qu’EDF, VINCI Energies, EURODISNEY mais aussi des cabinets d’expert-comptable comme le Cabinet Jégard ont initié les premières démarches avant même que la facture électronique ne devienne obligatoire. Ces derniers sont intervenus dans le cadre de la Journée de la facture électronique pour nous faire part de leur retour d’expérience.

Le retour d’expérience d’EDF

En 2017, EDF devait traiter un volume total d’environ 700 000 factures. L’entreprise recevait déjà des factures d’achat sous format électronique d’une partie de ses fournisseurs. Ce contexte a favorisé leurs premières démarches vers une dématérialisation de leurs factures. Voici les 4 quatre bénéfices que l’entreprise EDF a retiré à l’issue de la mise en œuvre de ce processus :

- une baisse des charges administratives et des erreurs de facturation liées à la gestion des factures sous format papier ;

- une réduction des délais de transmission, ce qui améliore la relation avec leurs fournisseurs ;

- une réduction de l’empreinte carbone ;

- un meilleur suivi du statut de traitement des factures (du dépôt à la mise en paiement).

Le retour d’expérience de Vinci Energies

L’enjeu principal de VINCI Energies est lié à leur stratégie de croissance externe avec le passage de 13 à 57 pays en 2021. Cette internationalisation s’est accompagnée de nouvelles problématiques, notamment l’augmentation du nombre de factures et la diversité des contraintes légales en termes de dématérialisation suivant le pays dans lequel elle opère. Le travail d’harmonisation de leurs deux ERP – SAP et Navision & BC – a été l’élément fondamental pour démarrer leur processus de dématérialisation des factures. Entre 2016 et 2021, le volume de factures dématérialisées est passé de 300 000 à 4,5 millions. La transition s’est accélérée en 2020 par le déploiement de l’EDI et de la Factur-X. L’adoption de la facture électronique est pour eux synonyme à la fois de gain de temps et d’une plus grande efficacité sur leurs processus opérationnels.

Le retour d’expérience de DISNEYLAND Paris

Pour Disneyland Paris, la dématérialisation se réalise sur les factures fournisseurs et sur celles du personnel intérimaire (à hauteur de 99%). L’entreprise souhaite de ce fait même réduire les problèmes de délais de paiement, les risques d’erreur liées à la facture papier et limiter leur empreinte carbone. Avec plus de 300 000 factures annuelles, la société tend progressivement à se tourner vers un traitement automatique de ses factures. Et pour évaluer les retombés positifs d’un tel changement, elle regarde le taux d’efficience des factures EDI, actuellement de 56% entre 2021 et 2022, contre 24% pour la facture papier. L’objectif est donc d’augmenter ce premier taux à mesure que la facture électronique sera adoptée entièrement par elle-même et toutes ses parties prenantes.

La vision du Cabinet Jégard

Concernant la vision d’un expert-comptable, le Cabinet Jégard spécifie que les sociétés qui franchissent le pas de la facture électronique sont très satisfaits et ne souhaitent pas revenir en arrière. L’avantage déterminant dans son domaine est de permettre une comptabilité instantanée grâce au traitement automatisée de la facture et ainsi se focaliser sur son métier d’analyste et de conseiller. De même, il est intéressant pour ses clients d’effectuer cette dématérialisation car elle ajoute, in fine, de la valeur ajoutée à leurs propres solutions.

5. Quelles sont les bonnes pratiques à adopter pour accompagner le processus de dématérialisation des factures ?

Tout d’abord, le déploiement ne peut se faire sans une équipe interne regroupant tous les acteurs impactés par ce processus. Ces parties prenantes devront être mises au courant de la réforme fiscale en cours. De plus, une analyse de l’état des lieux de l’existant sera nécessaire. Cela passera notamment par la caractérisation de ses clients (plutôt domestiques ou internationaux, en B2B ou B2C) et la maturité de la pratique de la facturation (avec un usage de factures entrantes et/ou sortantes, puis le type de format employé – plus facture papier, en fichier PDF ou encore en facture électronique).

Ensuite, l’établissement des règles d’adressage des factures devra être réalisé et communiqué à vos clients et à vos fournisseurs pour éviter des pertes futures de factures. En parallèle, cela supposera de renseigner l’annuaire des destinataires auprès de la PDP et donc de revoir toute la base de données de vos contacts.

Un autre axe auquel il est nécessaire de s’atteler : c’est l’automatisation de l’intégration des factures via l’EDI. En tant que destinataire, cela nécessite de communiquer à mes fournisseurs les données dont j’ai besoin et une fois réceptionnées, de les intégrer au système d’information.

Enfin, suivant les besoins propres à votre entreprise, la dernière étape est de choisir le bon opérateur de dématérialisation puisqu’il va avoir accès à des données très sensibles. Le prestataire de service doit assurer un degré élevé de sécurité sur les données électroniques, facilité le suivi à temps réel des statuts du cycle de vie de la facture électronique et disposer des différents niveaux d’interopérabilité.

Conclusion

ICD International possède une expertise de plus de 30 ans dans le domaine de la facture électronique. Nous pouvons répondre aux différents niveaux d’interopérabilité décrits par l’état. Nous pouvons vous accompagner dans le choix d’un format structuré, dans l’adressage, dans la conformité avec les règles du DGFiP, dans la transmission de la facture et son suivi. Si le passage à la facture électronique obligatoire apparaît contraignant, nous vous aiderons à en faire un atout. Grâce à cet accompagnement, vous pourrez tenir vos échéances en vue de la réforme fiscale 2024.