With companies obliged to make the digital transition, invoice is playing a key role. In fact, invoice processing is often one of the first Digitalization projects to which companies commit.

What is invoice ?

An electronic invoice is not simply a invoice that has been sent as an e-mail attachment. No, an electronic invoice is a invoice that has been generated, sent and archived in a digital format and in compliance with the legal framework in force.

The notion of invoice should also be distinguished from Digitalization , which refers to theautomation invoicing process.

However, these two terms are complementary, as automation invoice processing necessarily relies on digital documents, such as electronic invoices. These documents can be in different file formats (EDI, XML, PDF).

Digitalization invoices: two international approaches

Digitalization invoicing is an international issue for several reasons. Firstly, each country has implemented or is implementing a legislative framework to regulate the use of invoice electronic invoices. Secondly, companies operating internationally have a strong interest in digitalize their customer and supplier invoice handling processes, provided they comply with the regulatory constraints of each country.

Internationally, two models govern the use of invoice :

- The clearance model, which requires prior state approval for each invoice before it is passed on to the purchasing company.

- The post-audit model, which lets companies exchange invoices freely, provided they can prove the integrity, authenticity and legibility of each invoice invoice over a given period.

invoice What is the legal framework in France?

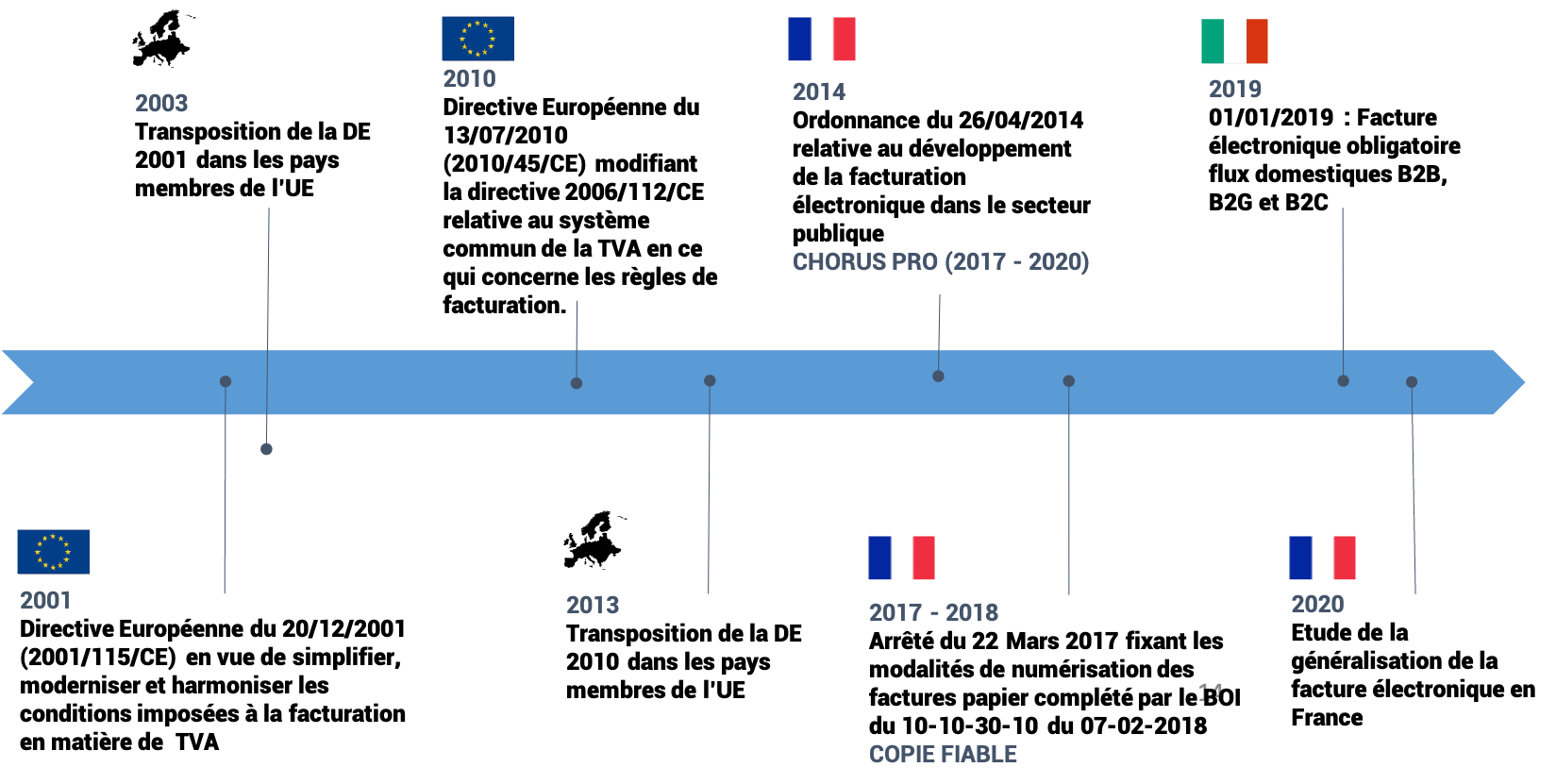

Since 2010, the French government has been implementing a number of measures to encourage companies to adopt invoice .

The European directive 2010-45 CE provides a framework for the use of invoice electronic devices, indicating 3 state-recognized channels:

1 - simple PDF

This first approach requires the establishment of a reliable audit trail, which consists of the implementation of documented and permanent internal controls on the flow of transactions in order to certify the origin of the invoice, guarantee the integrity of its content and the legibility of the invoice issued or received.

2 - The signed PDF

This second option requires the use of a Electronic signature created using a secure solution that affixes a qualified certificate.

3 - EDI fiscal

This 3rd option is based on the use of EDI (Electronic Data Interchange) technologies, which comply with tax standards.

Other provisions have been added to the framework for the use of invoice .

In 2014, the Order of June 26 made it mandatory for suppliers to public authorities and institutions to use the dedicated Chorus Pro portal, invoice .

In 2017, regulatory texts introduced the notion of a reliable copy, freeing companies from the need to archive invoices on paper. This means that invoice paper invoices can now be digitized, processed and archived electronically, provided that the electronic version conforms to the original, that its integrity is guaranteed by electronic certificate and that a reliable audit trail is established.

To fully understand the main principles of invoice electronic, discover the replay of this Webinar [Webinar invoice " Did you say "Reliable Audit Trail"?]

2024: Electronic invoice mandatory for all companies

The Finance Act 2020 marks a major step forward for the widespread use of electronic invoice . Article 153 makes the use of invoice mandatory for all companies subject to VAT.

This measure has several objectives that will benefit both the state and companies:

- Strengthen companies' competitiveness by reducing the administrative cost of invoice processing and improving payment times

- Combating VAT fraud through automated cross-checks

From 2024 (formerly 2023), all companies will be required to use invoice electronic invoices. The 2020 finance law requires organizations of all sizes to be able to receive electronic invoices according to the terms set by the state.

In concrete terms, the invoice processing scheme that has been set up consists of having invoices issued by companies validated beforehand by a certified trusted third-party intermediary, who will extract and transmit to the government the data required by the tax authorities. This is the so-called Y model

In addition, companies will have to accompany invoices with a e-reporting, an electronic file containing additional mandatory accounting information.

Find out more about our platform in this Webinar replay

invoice electronic: the question of archiving

Whether invoices are issued or received in digital format, or as reliable copies, the question of archiving remains unanswered. French legislation requires invoices to be archived for a period of 10 years, in order to preserve and guarantee the 3 key obligations of invoice :

- Authenticity

- Integrity

- Readability.

These conditions for archiving with probative value require that documents be electronically signed and time-stamped, that the archiving technology be non-rewritable, and that access to archives be controlled and traced.

Generally speaking, compliance with these legal constraints is essential to justify the collection or deductibility of VAT and prevent any penalties from the tax authorities.

Electronic invoices: what are the benefits?

In addition to complying with current legislation, invoice offers a number of benefits.

-

Cost reduction

Numerous studies show that digital processing of a invoice offers significant savings (up to 70%). By dematerializing and automating the invoice processing process, there are also indirect gains linked to the acceleration of the processing cycle, the reduction of data entry errors and disputes which are sources of costs for the company (time spent, payment delays, commercial sanctions...).

-

Optimizing company cash flow

By speeding up invoice processing times, payment delays are reduced, with a significant impact on cash flow. The ability to process supplier invoices more quickly means better commercial terms. On the customer side, the adoption of invoice electronic invoicing helps to reduce late payments, which can put a strain on the company's cash flow.

-

Ensure regulatory and tax compliance

Invoicing processes are tightly controlled by the tax authorities, and future regulations will require all companies to use invoice electronically for both incoming and outgoing invoices. The aim of these measures is to combat VAT fraud and simplify tax compliance for businesses.

-

Reliable and secure exchanges

The use of invoice dematerializes the end-to-end process to guarantee traceability of invoices and their processing. Whether you opt for EDI, Electronic signature or a reliable audit trail, you can easily substantiate a financial flow, identify the business activity to which an invoice corresponds, and track the status of the invoice. invoice

-

Embarking on the company's digital transition

A common project for many companies, digital transformation impacts all departments within organizations. The implementation of invoice is often a first step in digital transformation, because the process is already well oiled and documented.

-

A CSR and eco-responsible approach

Well-anchored in corporate strategies, the CSR approach is also supported by invoice . The Digitalization invoicing system offers immediate benefits by significantly reducing the need for printing, and therefore ink and paper consumption.

-

Improve team productivity

The use of invoice and theautomation of its management processes reduces the volume of time-consuming, low value-added tasks. Not only does this increase the overall efficiency of the organization, it also enables account teams to concentrate on more relevant activities.

What solutions are available for invoice ?

Implementing invoice electronically under the new legislation involves deploying the solutions needed to apply the Y-scheme imposed by the tax authorities

However, the system provides multiple invoicing circuits to fit in with existing practices and not jeopardize equipment still in use on the premises:

- Exchanges between two companies transmitting directly via the public platform or a non-certified Digitalization operator

- Exchanges between a company that transmits directly to the public platform and a company that dematerializes via a certified private platform

- Exchanges between two companies that transmit via certified private platforms.

The technologies used remain the same as those already exploited by pre-existing Digitalization solutions: EDI, API, web portal...

How do you set up invoice in your company?

The widespread introduction of invoice electronic invoicing is an opportunity for companies to embark on the path towards Digitalization for the processing of their customer and supplier invoices.

However, such a project cannot be improvised, and involves the whole company. The methodology developed and the involvement of senior management are key to the project's success.

The steps required to launch such a project are as follows:

- Auditing the financial and IT context

- Define issues, project scope and target organization

- Define project resources and players

- Define deployment strategy, timetable and KPIs

Once this strategy phase is complete, the next step is to deploy and customize the Digitalization platform. This stage must also includeonboarding customers and suppliers, and ensuring that invoices are properly transmitted between the various players.

The next step is to manage change within the company. This is the cornerstone of the project, enabling all teams to adopt the solution, test processes and fine-tune them before going live.

Finally, the production of dashboards and KPI's to manage billing flows provides the tools needed to control, anticipate and fine-tune the system.

Experts in Digitalization for over 30 years, ICD international offers a complete, scalable and modular Digitalization invoicing platform.