Switch to e-invoicing and optimize your business processes invoice

2026: invoice becomes mandatory

Between 2026 and 2027, companies in France subject to VAT will have to exchange invoices in electronic format, and will be required to systematically transmit mandatory data to the tax authorities via a public platform.

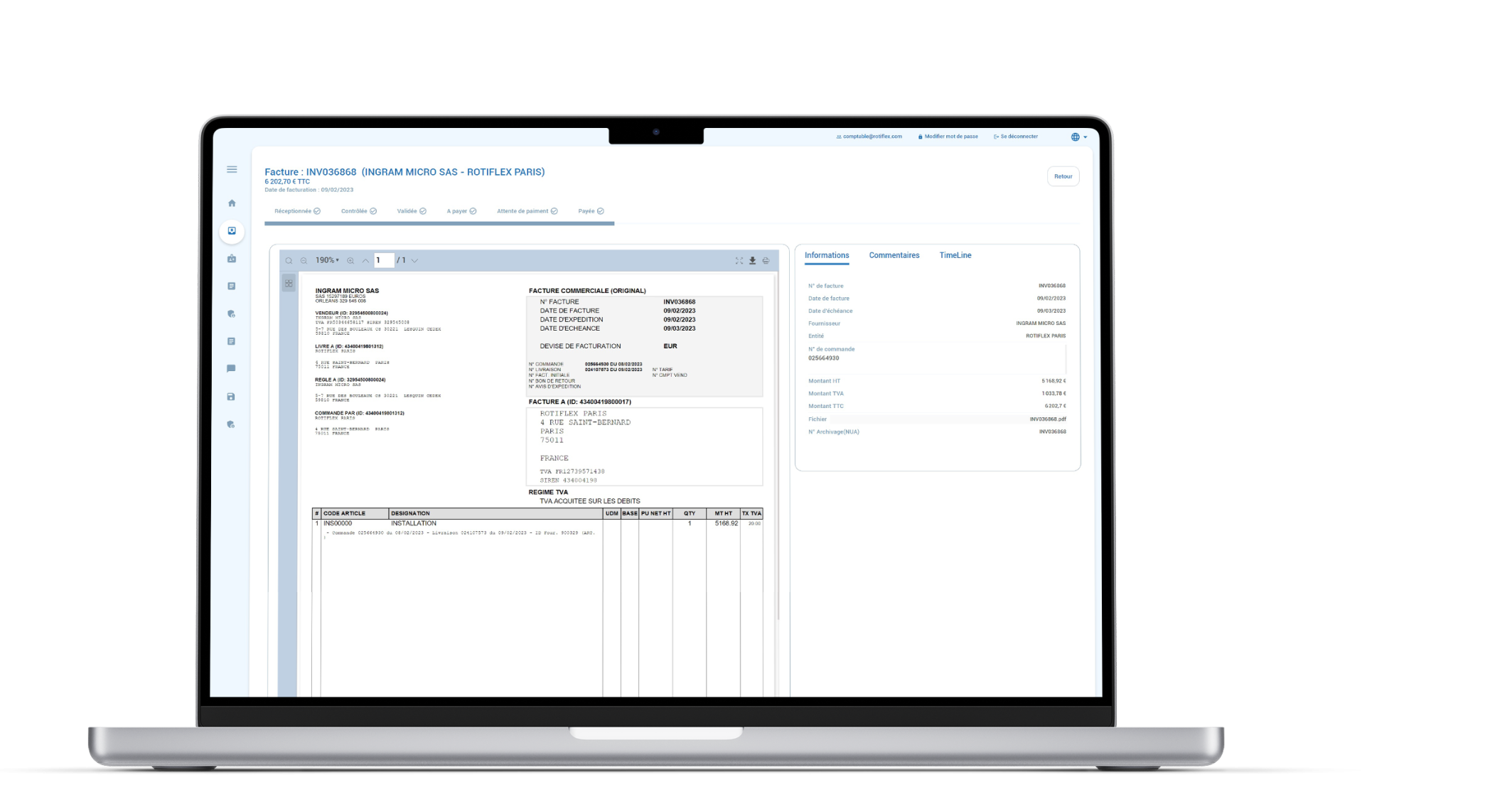

The most comprehensive invoice platform Digitalization Procure-to-Pay and Order-to-Cash

Dematrust is a unique platform for Digitalization customer and supplier invoices. It covers the requirements of PDP 2026, but also offers a complete business solution to help your organization optimize andautomation its customer and supplier invoicing processes.

Switch to invoice electronic 2026

Make sure your electronic invoicing is compliant

Dematrust PDP 2026 complies with legislation in 60 countries

Main features

Optimize your cash management

Optimize your supplier invoice processing

Main features

Shorten your DSO

Speed up the management of your customer invoices

Main features

Optimize your billing processes

Gain efficiency and complete visibility over the performance of your invoicing process

Main features

Webinar Replay

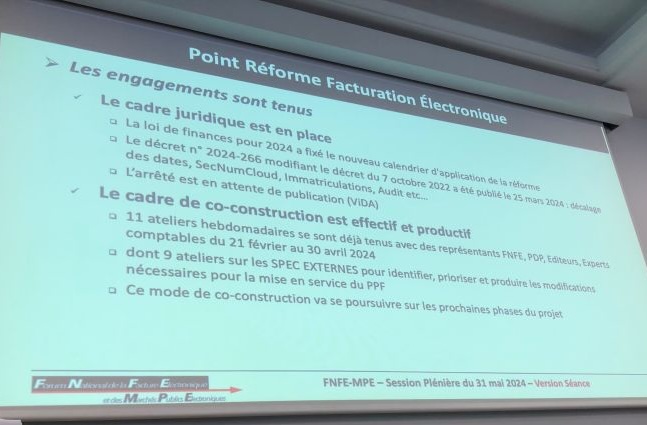

Compulsory electronic invoice is on the way : how can you prepare for it ?

Find out more about the system defined by the government, and the new players we can count on to meet the constraints of the reform, with a presentation by Cyrille Sauterau, President of FNFE - MPE.

ICD International with you every step of the way

Prepare your company

Our teams will help you anticipate and manage your transition to invoice electronically.

Deployment support

We deploy the solution with you to meet your business, organizational and technical challenges.

Customer support

A support team is at your disposal to answer all your questions.

Our customers say it best

The Digitalization solution for our customer invoicing flows has saved us precious time on a daily basis. In addition to productivity gains, we have seen an improvement in our processing times, and a reduction in anomalies and disputes.

Maxime Trou,

e-Procurement and Digital Sales Promotion Manager

We managed the project hand in hand. ICD International 's technical expertise, their excellent knowledge of the SAP environment and the rigor of their project approach enabled us to make the right choices when necessary.

Mélanie Troalen,

Project Manager

The Digitalization solution for our customer invoicing flows has saved us precious time on a daily basis. In addition to productivity gains, we have seen an improvement in our processing times, and a reduction in anomalies and disputes.

Maxime Trou,

e-Procurement and Digital Sales Promotion Manager

We managed the project hand in hand. ICD International 's technical expertise, their excellent knowledge of the SAP environment and the rigor of their project approach enabled us to make the right choices when necessary.

Mélanie Troalen,

Project Manager

The Digitalization solution for our customer invoicing flows has saved us precious time on a daily basis. In addition to productivity gains, we have seen an improvement in our processing times, and a reduction in anomalies and disputes.

Maxime Trou,

e-Procurement and Digital Sales Promotion Manager

We managed the project hand in hand. ICD International 's technical expertise, their excellent knowledge of the SAP environment and the rigor of their project approach enabled us to make the right choices when necessary.

Mélanie Troalen,

Project Manager

Switch to e-invoicing

and optimize your invoice handling processes

Dematrust Frequently asked questions

Is Dematrust compatible with ERP systems?

We have been operating EDI for over 35 years. Over the years, we have developed connectors and pivot files for all the ERP systems on the market.

How does the Dematrust solution fit into the Information System?

Dematrust interfaces with various management tools via connectors or APIs to retrieve or send billing data in the formats expected by your ERP systems

Does the Dématrust solution include an archiving solution?

Dematrust offers 10-year legal archiving with a consultation interface within the solution.

Is it possible to apply business-specific controls to invoices in addition to those required by law?

Dematrust performs all the legal controls imposed by the reform. Depending on your needs, it is possible to set up specific controls on Dematrust.

What is the average deployment time for Dematrust ?

The average project time is around three months. This time may be shorter or longer, depending on the complexity of your internal organization.

How much does the solution cost?

Our sales offer is structured around 2 areas:

- PDP perimeter including invoice production in the required format

- Business scope including advanced business functions.

For the 2 perimeters, tariffs are composed of :

- Initialization and implementation costs

- Decreasing flat rate according to the number of invoices processed

Our latest content

FAQ invoice electronic

What is invoice ?

An electronic invoice is a digital document that replaces the traditional paper invoice , making it easier to Digitalization invoices.

What is the format of an electronic invoice ?

The format of an electronic invoice may vary according to specific regulations and company preferences. However, some formats are more commonly used internationally, such as XML, Factur-X or PDF/A.

What are the advantages of invoice ?

With invoice , you can reduce costs, improve process efficiency, speed up payments and increase transaction security.

What is the difference between invoice and Digitalization ?

invoice is a invoice format, while Digitalization is the process of managing invoices digitally.

How does the reform affect SMEs?

By September 1, 2026, all SMEs must be able to receive electronic invoices. By September 1, 2027, they will have to issue their own electronic invoices to comply with the new European legislation.

How does the reform affect GEs and ETIs?

By September 1, 2026, all large and medium-sized companies will have to be able to receive and issue electronic invoices to comply with new European legislation.

How do I choose the right invoice solution for my business?

Evaluate the functionality, compatibility with your current systems, and customer support offered by the e-invoicing solution.

Is invoice mandatory for all transactions in France?

Electronic invoice is mandatory for transactions with the government, and is gradually becoming mandatory for all VAT-registered business transactions.

Is invoice mandatory for international business?

The requirement for electronic invoice varies from country to country. For example, it is compulsory for all companies in Italy, and is becoming mandatory in many other EU countries such as Romania, Spain and Germany, as well as across the Atlantic in Brazil, for example.

How long can electronic invoices be kept for tax purposes?

The duration varies from country to country, but most legislations require that electronic invoices be kept for a minimum period of between 5 and 10 years.