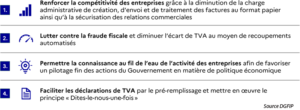

Reminder and objectives of the reform

The new platform will meet the reform requirements of Article 153 of the 2020 Finance Act.

It is based on 4 key objectives:

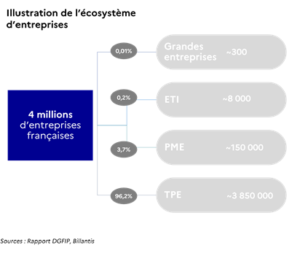

Who is affected by the reform of article 153?

All VAT-registered businesses in France, representing a volume of over 22 billion invoices a year for 4 million companies. Invoices are distributed as follows

B2G: 100 million invoices a year

B2B: 2 billion invoices a year

B2C: > 20 billion transactions per year

Illustration of the ecosystem of companies affected by article 153 of the LFP 2020

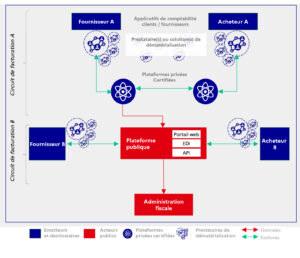

System set up by the DGFIP

The system chosen by the DGFIP will follow a Y pattern. This will take into account the various billing circuits, including certified private platforms.

Chorus Pro: the government's solution

The current Chorus Pro exchange platform will be the application base for the reform. Chorus Pro is the portal that meets the French government's obligations to digitalize invoices from the private sector to public entities. Since its introduction in 2007, Chorus Pro has processed over 120 million invoices, and this figure continues to grow.

This platform will also be extended to process invoices between private companies(B2B and B2C).

The documents concerned by the reform are invoices, corrective invoices and credit notes.

Exchanges with the public platform will be based on recognized standards to facilitate exchanges and data processing by the tax authorities. The public platform will use the formats most commonly used by Chorus Pro B2G, in compliance with European standard EN16931 and mandatory data.

For less computerized companies, native PDFs will be accepted for a period to be determined by the DGFIP.

Principle of a platform meeting the requirements of article 153

A national directory will list all companies affected by the reform, according to criteria to be established by the DGFIP in the coming weeks. The recommended identifiers are SIRET and SIREN. The directory will be fed mainly byINSEE's SIRENE database.

Companies without Digitalization solutions will be able to use certified platforms, or temporarily upload native PDFs to the platform.

Communication channels will be APIs, portals and EDI, which will be used by certified platforms, Digitalization operators and Chorus Pro users.

Invoices will be sent to the public platform via the various communication channels, and returned via the same channels. A lifecycle including receipt and payment statuses will be set up for invoice traceability.

The basis and principle of the Chorus Pro application has proven itself for over 10 years in the B2G sector. It was only natural that Chorus Pro should be extended to the B2B sector.

How to access this platform and the prerequisites will be described by the DGFIP in the next workshops to be held in May 2021.

The role of certified private platforms

Certified private platforms will be responsible for transmitting the invoice data required under article 153 of the LFP to the national platform. Certified private platforms will be able to receive invoices from your systems and return them in the format required by the tax authorities. PPCs (certified private platforms) are experts in Digitalization and will guarantee compliance with legal and tax requirements.

ICD international is at your disposal to answer any questions you may have, or to carry out preliminary studies. We can help you anticipate this change process by auditing your application systems and your functional and business processes.

We are now candidates to become PDP. Discover our solution: