Malaysia has undertaken a major reform of its tax system with the implementation of mandatory electronic invoicing. This initiative aims to modernize invoicing processes, increase tax efficiency and combat fraud. This article explores the scope of this reform, how it works, and the resulting obligations for companies operating in Malaysia.

Scope of the reform

The reform of electronic invoicing in Malaysia is part of a global drive to digitalize tax processes. It concerns all types of transaction(B2B, B2C and B2G), both domestic and international, and eventually all companies, regardless of size. This reform will be rolled out according to a progressive timetable established by the Malaysian tax authorities.

Implementation schedule

The implementation of electronic invoicing takes place in several phases:

- Phase 1 (August 01, 2024): Companies with sales in excess of MYR 100 million. (19 585 516 €)

- Phase 2 (01 01 2025): Companies with sales in excess of MYR. 25 million.(4 893 500 €)

- Phase 3 (01 07 2025): All remaining companies.

A Clearance model

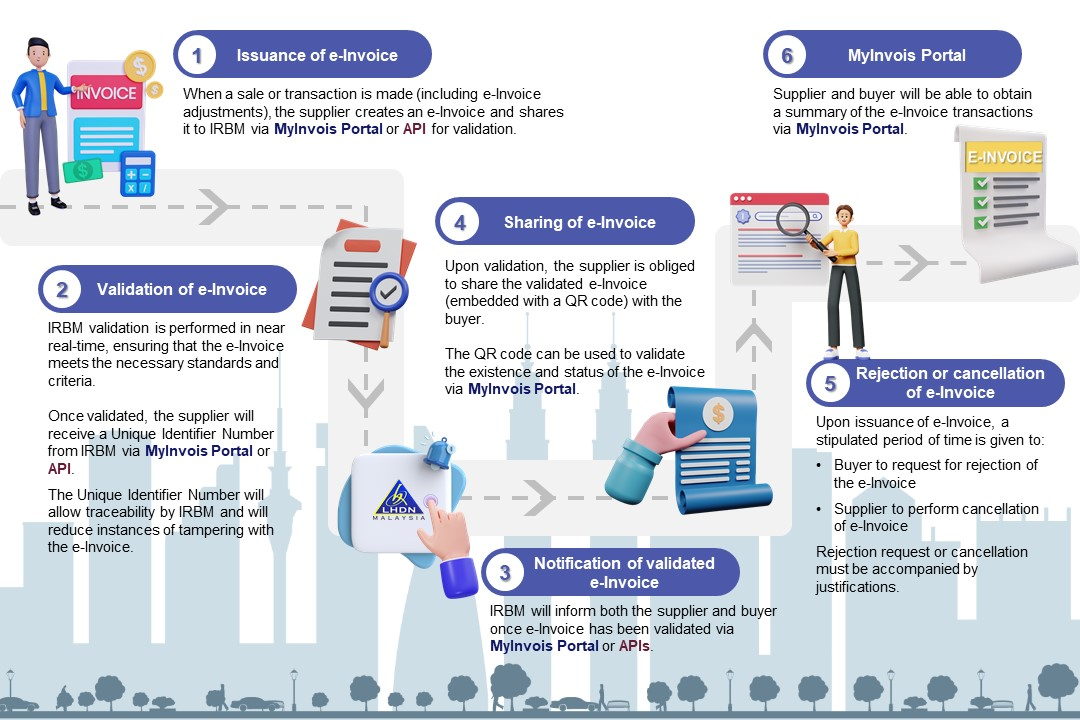

Malaysia's electronic invoicing system is based on the clearance model.

In other words, electronic invoices must be issued and transmitted via a centralized platform managed by the Malaysian tax authorities (IRBM). This process involves several steps:

- Emission de la facture :

Les entreprises créent leurs factures via la plateforme MyInvois soit en utilisant la solution gratuite mise à disposition par l’IRBM, soit en utilisant leur système de gestion ou un logiciel de facturation connecté à la plateforme étatique. Les factures devront être créées dans un format structuré XML ou JSON. - Validation :

La facture est ensuite transmise à la plateforme centralisée qui vérifie la conformité de la facture avec les réglementations fiscales en vigueur pour la validée. Un numéro d’identification unique est lui est attribuée. - Transmission :

L’émetteur de la facture transmet au destinataire la facture validée pour règlement. - Archiving

The invoice is electronically archived and conversed by the IRBM.

Preparing for compliance

In order to enable companies to prepare for their transition to the invoice and test integration with the platform, the IRBM has deployed a test environment for the MyInvois platform.

Since April 22, 2024, MyInvois Sandbox has enabled Digitalization companies and service providers to test the integration of their systems with the state platform.

ICD International is supporting its customers in these integrations, with a view to going live on August 1, 2024.